Washington (TIP)- The U.S. economy grew faster than expected in the second quarter amid solid gains in consumer spending and business investment, but inflation pressures subsided, leaving intact expectations of a September interest rate cut from the Federal Reserve.

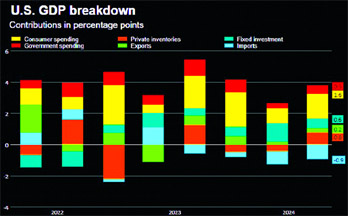

Growth last quarter also received a boost from inventory building as well as increased government spending, the Commerce Department’s advance report on second-quarter gross domestic product on Thursday showed. The housing market recovery, however, regressed and was a small drag on the economy. The trade deficit widened further, subtracting from GDP growth. The report dispelled concerns that the economic expansion was in danger of an abrupt end, which had been stoked by a lackluster performance in the first quarter and in April. The economy continues to outperform its global peers, despite hefty rate hikes from the U.S. central bank in 2022 and 2023, thanks to a resilient labor market.

“Economic growth is solid, not too hot and not too cold,” said Christopher Rupkey, chief economist at FWDBONDS. “Inflation looks to be going the Fed’s way and an easing of monetary restraint with an interest rate cut is likely in September.”

Gross domestic product increased at a 2.8% annualized rate last quarter, the Commerce Department’s Bureau of Economic Analysis said in its advance estimate of second-quarter GDP. That was double the 1.4% growth pace in the first quarter.

Economists polled by Reuters had forecast GDP rising at a 2.0% rate. Estimates ranged from a 1.1% rate to a 3.4% pace.

The growth rate in the first half of the year averaged 2.1%, half the 4.2% pace logged in the last six months of 2023. That is just above the 1.8% pace viewed by U.S. central bank officials as the non-inflationary growth rate.

Consumer spending, which accounts for more than two-thirds of the economy, increased at around a 2.3% rate after slowing to a 1.5% pace in the January-March quarter. Spending was driven by increased outlays on services like healthcare, housing and utilities as well as club memberships, visits to sports centers, parks, theaters and museums, and gambling.

Consumers also boosted outlays on goods, including new light trucks, recreational goods and vehicles, furnishings and durable household equipment as well as energy products.

Spending was in part supported by wage gains. A separate report from the Labor Department on Thursday showed the labor market steadily easing, with initial claims for state unemployment benefits dropping 10,000 to a seasonally adjusted 235,000 for the week ended July 20. Business investment picked up as spending on equipment, mostly aircraft, surged at an 11.6% rate after rising at only a 1.6% pace in the first quarter. Spending on intellectual property products continued to rise, though the pace slowed from the brisk rate in the January-March quarter.

Businesses also accumulated more inventory, which increased at a $71.3 billion rate after rising at a $28.6 billion pace in the prior quarter. Inventories added 0.82 percentage point to GDP growth after being a drag for two straight quarters. That more than offset a 0.72 percentage point hit from a wider trade gap. Source: Reuters

Be the first to comment