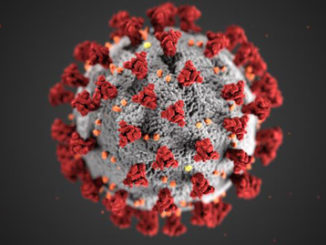

HONG KONG (TIP): Asian markets have been blended Friday, Dec 3, as merchants tracked developments within the Omicron virus pressure because it spreads around the globe, fuelling considerations concerning the financial restoration, simply because the Federal Reserve units the stage to withdraw its huge pandemic-era monetary assist.

Hong Kong was among the many principal losers with a number of dual-listed tech giants taking a success after US officers adopted a rule permitting them to take away international companies from Wall Avenue until they offered sure data to auditors, a transfer primarily focusing on Chinese language entities.

World markets have whipsawed because the Omicron variant hit headlines final Friday over considerations that it could be much more transmissible than the Delta pressure and that vaccines could also be much less efficient towards it.

Whereas a few of the preliminary panic has died down, with some suggesting it may very well be milder and that inoculations could be efficient, specialists have mentioned it may take as much as three weeks to get a full image of the outlook and its doable financial affect.

For now, governments are taking part in it cautiously, imposing contemporary containment measures together with journey curbs and a few lockdowns, which observers worry may knock the already shaky restoration off observe.

In the meantime, central banks proceed to tighten their belts, having stumped up trillions of {dollars} to get by way of the preliminary jolt from the pandemic final yr with some having already lifted rates of interest twice as they face a battle towards hovering inflation.

Eyes are actually on the Federal Reserve, which, after months of claiming the spike in costs was short-term, has now turned its give attention to maintaining them from working uncontrolled and is making ready to tighten its belt.

Boss Jerome Powell advised this week the financial institution would probably velocity up the taper of its bond-buying programme after which give attention to lifting borrowing prices.

Whereas the strikes have been nicely telegraphed, buyers are actually having to regulate to the tip of the age of low-cost money, which has been a key driver of the rally in world markets to report or multi-year highs in 2021.

Be the first to comment