I.S. Saluja

NEW YORK (TIP): It may be the biggest scandal in corporate history in India in recent times. The Hindenburg report on Adani conglomerate has created shockwaves in the financial world. Nobody can wish away or wash away the findings of the Hindenburg investigation. It is not the first time that Hindenburg has investigated a corporate .

Earlier, in 2020, Hindenburg published a report detailing malfeasance at the electric vehicle firm Nikola Corp. Hindenburg said Nikola had engaged in an “intricate fraud,” including an instance in which the company faked a video that appeared to show one of its electric trucks driving down a highway. In actuality, the company “simply filmed it rolling down the hill.” Nikola founder Trevor Milton was later found guilty of securities fraud after Hindenburg’s allegations prompted an investigation

A New York Post report of January 25 quoted Hindenburg Research Group as alleging that Gautam Adani, Asia’s richest man, is pulling “the largest con in corporate history” through his India-based conglomerate Adani Group”

Hindenburg — whose previous targets have included electric truck makers Nikola and Lordstown Motors — revealed in a research note late Tuesday it had taken a short position in Adani Group and alleged that Adani’s rise in wealth was fueled by a variety of illegal misdeeds, The New York Post said.

“We have uncovered evidence of brazen accounting fraud, stock manipulation and money laundering at Adani, taking place over the course of decades,” Hindenburg claimed in the note.

Adani, 60, amassed a fortune estimated by Forbes at $125.5 billion before the Hindenburg report — overseeing a sprawling network of companies with holdings across several industries, including control of major ports and airports, energy, real estate and cement.

“Adani has pulled off this gargantuan feat with the help of enablers in government and a cottage industry of international companies that facilitate these activities,” the firm added.

He began Wednesday, January 25, trailing only French luxury goods magnate Bernard Arnault and Tesla CEO Elon Musk in overall wealth, according to Forbes. But Adani lost an estimated $6.5 billion during the day after the Hindenburg report, dropping him to fourth behind Amazon founder Jeff Bezos.

The firm noted that Adani Group has “previously been the focus of 4 major government fraud investigations” alleging money laundering, corruption and theft of taxpayer money.

Hindenburg said it conducted a two-year investigation of the Adani business empire — with research that included dozens of interviews, including some with former company executives, as well as an analysis of internal documents and due diligence visits at company-controlled sites.

The report alleged that Adani, several family members and other company executives oversee a network of offshore shell companies located in tax havens across Mauritius, the United Arab Emirates and the Caribbean.

Hindenburg alleged that some of the shell companies appeared to be hastily cobbled together, with websites “featuring only stock photos, naming no actual employees and listing the same set of nonsensical services.”

Hindenburg alleged that many of the shell companies are reportedly operated by Adani’s older brother, Vinod, or his “close associates.”

“The Vinod-Adani shells seem to serve several functions, including (1) stock parking / stock manipulation (2) and laundering money through Adani’s private companies onto the listed companies’ balance sheets in order to maintain the appearance of financial health and solvency,” Hindenburg said.

Hindenburg included a list of 88 questions about company operations that “we hope the Adani Group will be pleased to answer.” “Even if you ignore the findings of our investigation and take the financials of Adani Group at face value, its 7 key listed companies have 85% downside purely on a fundamental basis owing to sky-high valuations,” Hindenburg said.

The short seller stressed that its report “represents our opinion and investigative commentary” and urged readers to draw their own conclusions about Adani Group.

Adani Group has dismissed the report as baseless. Adani Group CFO Jugeshindar Singh said the company was “shocked” by Hindenburg’s allegations and issued a firm denial.

“The report is a malicious combination of selective misinformation and stale, baseless and discredited allegations that have been tested and rejected by India’s highest courts,” Singh said.

“The timing of the report’s publication clearly betrays a brazen, mala fide intention to undermine the Adani Group’s reputation,” Singh added.

Billionaire investor Bill Ackman was all praise for U.S. short-seller Hindenburg Research’s report on Indian conglomerate Adani Group, calling it “highly credible” and “extremely well researched.”

Hindenburg’s report on Wednesday accused the conglomerate of improper use of offshore tax havens and stated it held short positions in the company via its U.S.-traded bonds and non-Indian-traded derivative instruments.

Adani group loses $48 billion since January 25; FPO takes a hit in light of Hindenburg report

Adani Enterprises Ltd began a record $2.45 billion (₹20,000 crore) secondary share sale for retail investors on Friday, as a heavy selloff in Adani group companies intensified after an attack by a U.S.-based short seller.

Seven listed companies of the Adani conglomerate — controlled by one of the world’s richest men Gautam Adani — have lost a combined $48 billion in market capitalization since Wednesday, January 25, and saw falls in its U.S. bonds after Hindenburg Research flagged concerns in a report about debt levels and the use of tax havens.

Adani Enterprises aims to use the share sale proceeds for capital expenditure and to pay debt. The anchor portion of the sale saw participation from investors including the Abu Dhabi Investment Authority on Wednesday.

Bidding for the Adani Enterprises share sale for retail investors started on Friday and will close on January 31. The firm has set a floor price of ₹3,112 ($38.22) a share and a cap of ₹3,276. But on Friday the stock slumped to as low as ₹2,721.65, well below the lower end of the price offering.

Adani group stocks took a beating, falling up to 20% after Hindenburg Research’s damaging allegations. The group’s flagship Adani Enterprises, which launched the ₹20,000 crore FPO on Friday, tanked 18.52%. Adani Ports plunged 16%, Adani Power by 5%, Adani Green Energy by 19.99%, and Adani Total Gas by 20%.

In two days, the Adani group firms have lost a whopping ₹4,17,824.79 crore from their market valuation. The market valuation of Adani Total Gas plummeted ₹1,04,580.93 crore while that of Adani Transmission by ₹83,265.95 crore. Adani Enterprises market capitalization fell by ₹77,588.47 crore, Adani Green Energy lost ₹67,962.91 crore and Adani Ports by ₹35,048.25 crore.

The market valuation of Ambuja Cements declined by ₹23,311.47 crore, Adani Power by ₹10,317.31 crore, ACC by ₹8,490.8 crore and Adani Wilmar by ₹7,258.7 crore. The rout took shares of Adani Enterprises, the group’s flagship company, well below the offer price of its secondary sale, which had initially been offered at a discount.

In its report, Hindenburg said key listed Adani Group companies had “substantial debt”, putting the conglomerate on a “precarious financial footing”, and that “sky-high valuations” had pushed the share prices of seven listed Adani companies as much as 85% beyond actual value.

Billionaire U.S. investor Bill Ackman said on Thursday, January 26, that he found the Hindenburg report “highly credible and extremely well researched”.

Hindenburg said it held short positions in Adani through its U.S.-traded bonds and non-Indian-traded derivative instruments, meaning it is betting that their price would fall.

The Hindenburg report has encouraged political parties in India to demand a thorough investigation into the working and practices of the Adani Group.

Congress has demanded a ‘serious investigation’ by RBI and SEBI into allegations levelled against the Adani Group. In a strongly worded statement, Congress general secretary in-charge of communication Jairam Ramesh asserted that exposure of financial institutions like the Life Insurance Company of India (LIC) and the State Bank of India (SBI) to the Adani Group would have implications for the country’s financial stability and crores of depositors “whose savings are stewarded by these pillars of the financial system”.

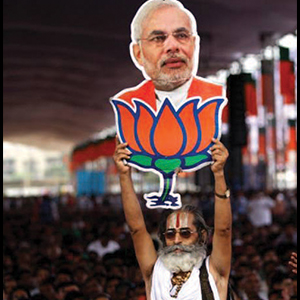

“Normally a political party should not be reacting to a research report on an individual company or business group prepared by a hedge fund. But the forensic analysis by Hindenburg Research of the Adani Group demands a response from the Congress party,” Ramesh said, adding, ”This is because the Adani Group is no ordinary conglomerate: it is closely identified with Prime Minister Narendra Modi since the time he was Chief Minister”.

The ports-to-power conglomerate, however, had said the charge against the Adani Group was “malicious, unsubstantiated, one-sided, and was timed to ruin the public listing of its shares”.

“The allegations require serious investigation by those who are responsible for the stability and security of the Indian financial system, viz. the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI),” Ramesh said.

“The allegations of financial malfeasance would be bad enough, but what is worse is that the Modi government may have exposed India’s financial system to systemic risks through the liberal investments in the Adani Group made by strategic state entities like LIC, SBI and other public sector banks,” he added.

The Congress leader said as much as 8% of LIC’s equity assets under management, amounting to a sum of ₹74,000 crore, are invested in the Adani Group of companies, while public sector banks have lent to the Adani Group twice as much as the private banks, with 40% lending being done by SBI. “Indians are increasingly aware of how the rise of Modi’s cronies has exacerbated the problem of inequality, but need to understand how this has been financed by their own hard-earned savings. Will the RBI ensure that risks to financial stability are investigated and contained? Are these not clear-cut cases of “phone banking”?” asked Ramesh.

Asking if there is a quid pro quo between the Modi government and the Adani Group, the Congress leader alleged, “In perhaps, the most egregious case of crony capitalism, the previous operator of Mumbai’s Chhatrapati Shivaji Maharaj International Airport, India’s second busiest airport, was raided by the Enforcement Directorate (ED) and the Central Board of Investigation (CBI) after it rejected an offer by the Adani Group”.

“The operator agreed to sell the airport to Adani a month later and it is a mystery what happened to the ED and CBI cases thereafter,” Ramesh added.

Lok Sabha member Manish Tewari said on Twitter that if the Hindenburg report was even partially correct, “it merits both a Joint Parliamentary Committee-much like the 1992 JPC & a Supreme Court Monitored investigation to get to the bottom of the matter. The Budget Session of Parliament begins 31st Jan 2023”.

Congress Rajya Sabha member Randeep Surjewala tweeted, ”Exposure of #LIC in Adani Group is ₹77,000 CR. LIC has today lost ₹23,500 CR in invest value in Adani Group i.e. at ₹53,000 CR against ₹77,000 CR. LIC is money of People of India. In any other country, heads would have rolled including that of FM# HindenburgReport.”

(Source: New York Post, Agencies)

Be the first to comment