NEW DELHI (TIP): A decline in sales is prompting automobile companies to slash production as demonetisation has adversely impacted buyer sentiment and hit footfalls at showrooms.

Few companies were willing to talk on record over the matter, but officials said in private that “things are getting increasingly difficult” after the ban on Rs 500 and Rs 1,000 notes that came into effect from November 8.

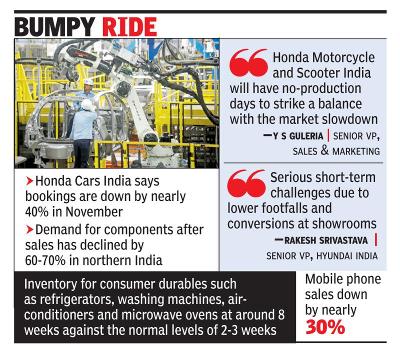

Honda Motorcycle and Scooter India (HMSI), the second-biggest two-wheeler manufacturer after Hero MotoCorp, said production is being “rationalised” to control inventories. The “correction” is being made both in factory production and dealer inventories, said Y S Guleria, senior VP (sales & marketing). “We are not loading the dealer with excessive inventory,” Guleria said adding that the company is working towards having “no-production days” to strike a balance with the slowdown.

Honda Cars India is also considering to align production to factor in slower offtake in the market, sources said. Jnaneswar Sen, senior VP for sales & marketing, has said bookings have come down by nearly 40% this month as the currency crunch is prompting people to withhold new purchases.

Officials at top manufacturers such as Maruti Suzuki and Hyundai did not confirm a slowdown in output, though retailers for these brands have spoken about a “massive squeeze” in demand. Rakesh Srivastava, senior VP (sales & marketing) at Hyundai India has, however, said there are “serious short-term challenges” due to lower footfalls and conversions at showrooms. Pawan Munjal, chairman of Hero MotoCorp, had also complained of a “steep drop” in footfalls at showrooms in the first two days of demonetisation, though adding that things are gradually returning back to normal.

Industry sources said companies and dealers are “not willing to take a chance” towards the end of the year and thus retail outlets are not being loaded with heavy inventories. “With the new year set to begin in about a month, dealers are not willing to be saddled with inventory of 2016. Companies are paying heed to their demand and adjusting output and stock levels.”

Component suppliers have already been briefed about the situation and many of them have started adjusting production schedules. “The supply crunch is severe, and at least this quarter will be hit badly. Things should look up from the new year as the cash flow gets normal.”

Some of the auto retailers and the allied industry are also facing problems in meeting working capital requirements. “The after-sales market for components is down by 60-70% in northern India. The situation is not healthy,” a top industry executive said.