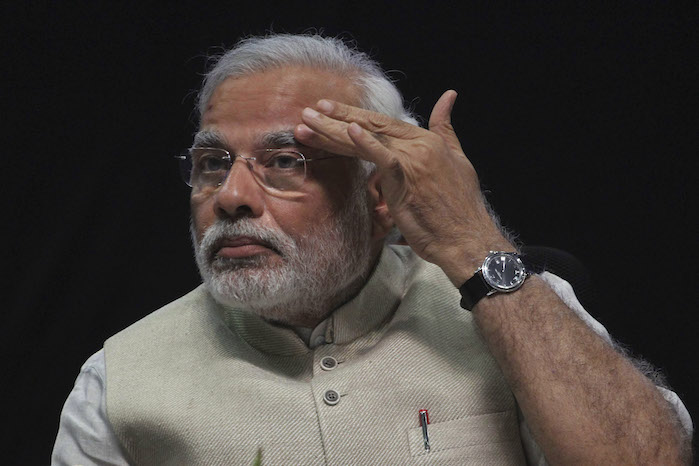

Rising religious intolerance in India got the world’s attention with Moody’s Analytics’s report — a division of Moody’s Corporation — as it called for Prime Minister Narendra Modi to keep his party members “in check or risk losing domestic and global credibility.”

In a report titled India Outlook: Searching for Potential, Moody’s Analytics said for the country to reach its growth potential it has to deliver the promised reforms.

BJP does not have a majority in the Rajya Sabha and such incidents may very well derail its economic agenda in the upper house where it needs support of other parties to pass legislation.

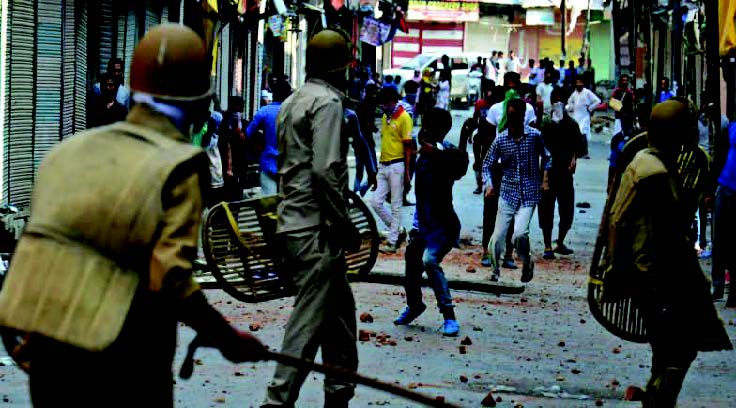

“While Modi has largely distanced himself from the nationalist gibes, the belligerent provocation of various Indian minorities has raised ethnic tensions. Along with a possible increase in violence, the government will face stiffer opposition in the Upper House as debate turns away from economic policy. Modi must keep his members in check or risk losing domestic and global credibility,” said Moody’s Analytics.

“Overall, it’s unclear whether India can deliver the promised reforms and hit its growth potential. Undoubtedly, numerous political outcomes will dictate the extent of success,” said the report.

Bihar Elections : Stating that the ruling coalition does not have a majority in the upper house to pass crucial reforms, the report also pointed out the importance of the ongoing elections in Bihar where BJP is not the incumbent and a victory there for the party will help secure a majority in the upper house which is critical for passing important legislation. “The state election in Bihar—one of India’s largest and poorest states—could prove pivotal to Modi’s leadership. The BJP is not the incumbent, so a win here would help secure an upper house majority,” said the report adding that better political outcomes could help India achieve reforms.

Since 2004, Moody’s has rated India at ‘Baa3’ which is the lowest investment grade.

Here are several other instances where Moody’s pointed out downgradation of Indian economy.

1. Hitting out at Modi government: In June, Moody’s lashed out at Modi government by flagging subdued rural economy as a ‘credit negative’ for India’s sovereign rating.

The agency said there are growing concerns about risk of policy stagnation and ‘some diappointment’ was pointed out over the pace of reforms under the Modi government.

2. Banking system: Moody’s had said earlier that the weak asset quality of banking system poses sovereign credit because of the banking sector’s role in financial growth. It said, “In the absence of any improvement in banking-system metrics over the coming months, India’s sovereign credit profile will remain constrained.”

3. Moody’s downgraded India’s GDP growth projection: Citing a ‘drier than average monsoon’ Moody’s revised its GDP growth projection to 7% from 7.5% in August.

The agency had maintained India’s growth forecast of 7.5% for the year 2016 which was revised later.

“Our polling results pointed to some disappointment amongst the audience with regard to the pace of reform under the administration of Prime Minister Narendra Modi, and increasing concerns about the risk of policy stagnation,” Moody’s had said in June in a report titled ‘Inside India’.

4. Moody’s downgraded banks: In other instances, Moody’s has also downgraded banks like Bank of India, Canara Bank, to ba3 from ba2 on account of rise in NPA. It downgraded ratings for Central Bank of India and Indian Overseas Bank’s local and foreign currency deposits from ‘Baa3’ to ‘Ba1’. The reason being differentiating between public sector banks when distributing capital.

The government indicated further that efficient banks will receive capital from the government of India.

Moody’s has also downgraded local currency bank deposit ratings of major banks such as HDFC Bank, ICICI Bank and Axis Bank.

“The downgrade is driven by the change in Moody’s view that the capacity for government support is limited to a government’s bond rating, rather than Moody’s previous expectation that banks in India could benefit from additional support through other policy tools,” it said in a note.

5. When Moody’s thought India would give an indecisive mandate: The agency has pointed out that political and policy uncertainty ahead of 2014 general elections has been the cause of macro-economic imbalance between 2011 and 2013.

However, Moody’s said, “We rank India’s institutional strength as moderate (-) relative to all other countries in the Moody’s-rated universe.”

(With Agencies)

Be the first to comment