WASHINGTON (TIP): Indian American congressmen came down heavily on the tax reforms of the Trump administration calling the tax bill passed by the US Congress as “tax scam.”

Congressman Raja Krishnamoorthi said that the tax bill would add nearly $1.5 trillion to the national debt while destabilizing the healthcare system of the nation.

“House Republican egos just wrote a check the middle class shouldn’t have to cash. The tax bill Republicans just jammed through would add nearly $1.5 trillion to the national debt while raising taxes on working families, and destabilizing our health care system by leaving 13 million more Americans without insurance – including 2 million who currently have employer-provided coverage,” Krishnamoorthi said in a statement.

“This legislation is a ticking tax bomb: millions of middle-class families could see their taxes increase over the next decade as state and local tax deductions and other middle-class provisions get dramatically scaled back. Health insurance premiums will jump by 10 percent per year, and massive additional debt will be piled on the backs of our children and future generations,” he added.

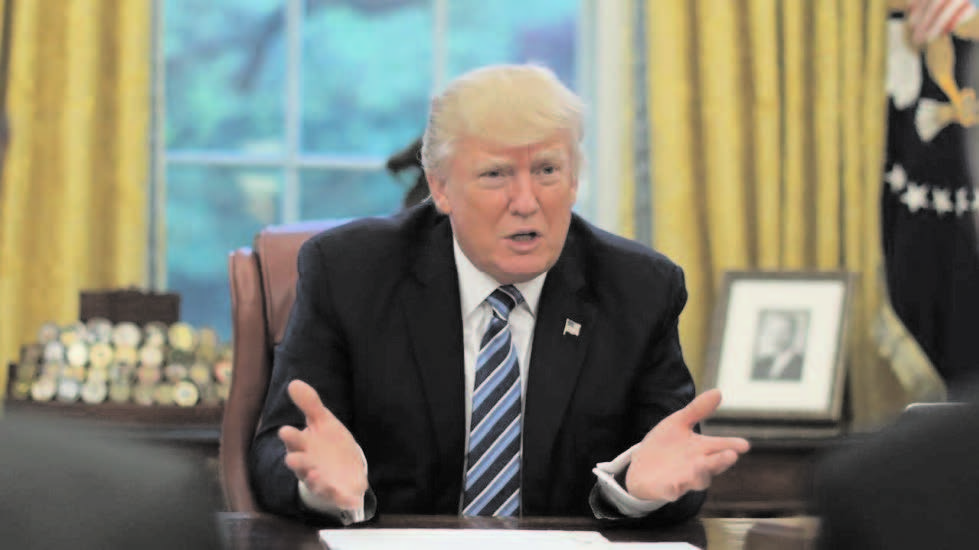

The tax bill that is considered to be the biggest reform of the US tax code in 30 years was approved by the House of Representatives on Wednesday.

Though the Democratic party unanimously voted against the act, the $1.5 trillion tax bill was passed by the Senate and House of Representatives which is considered as President Donald Trump’s first major legislative victory.

“The Republicans can’t fool the American people with their trickle-down scam. 76 percent believe that the tax bill will help large corporations while only 28 percent believe that the tax cuts will be used to create jobs. This unpopular #GOPTaxScam must be rejected,” tweeted Rep. Ro Khanna.

“It’s hard to believe, but Republicans have made the final version of their tax bill even more generous for the wealthiest Americans by lowering the highest individual rate to 37 percent. How is this supposed to grow the economy? The #GOPTaxScam is a bad deal for the middle class,” he wrote in another tweet.

Lowering the corporate tax rate to 21 percent from 35 percent is one of the major reforms brought by the Republicans. Along with this, the bill allows tax cuts for businesses, lower rates for many individuals and a narrower estate tax.

“The GOP tax scam bill is an all-out war on any idea of opportunity in this country. It’s a massive tax break for the ultra-wealthy on the backs of middle-class families. It’s outrageous that Republicans in the House voted to pass this love letter to their largest donors and corporations,” said Rep. Pramila Jayapal.

“This tax “plan” is little more than a gift to corporations and the top one percent and an attack on our values,” alleged Senator Kamala Harris.

“Instead of a real middle-class tax cut, the overwhelming majority of the benefits of this bill — an astounding 83 percent — go to the top one percent over the next decade,” she said.