- With Tax Season Underway, In-Person and Virtual Tax Preparation Services Will Be Available at City Public Hospitals in Various Languages

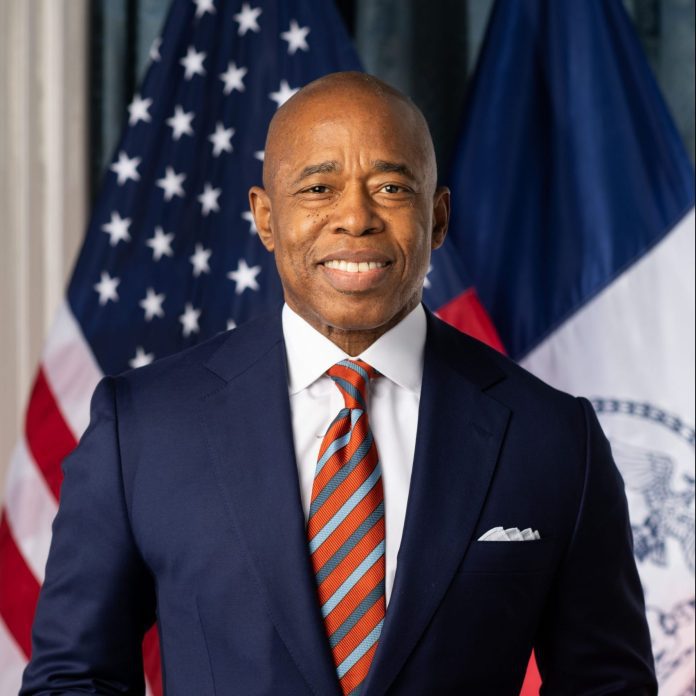

NEW YORK (TIP): New York City Mayor Eric Adams and NYC Health + Hospitals, on February 23, announced free, in-person, and virtual tax preparation services for New Yorkers as part of the New York City Department of Consumer and Worker Protection’s (DCWP) NYC Free Tax Prep initiative. In partnership with BronxWorks, Grow Brooklyn, Urban Upbound, and Code for America’s GetYourRefund initiative, free tax preparation is available for New Yorkers who earn $85,000 or less annually and file as a family, or those who earn $59,000 or less annually and file as an individual or couple without dependents. Select NYC Health + Hospitals sites offer support in Spanish, Chinese, and Bengali, and virtual tax preparation is available in Spanish as well.

“Every day, we work to make this city more livable for working-class New Yorkers, and by offering free tax preparation at NYC Health + Hospitals sites, we are again delivering for families across the five boroughs,” said Mayor Adams. “Services are available online, in-person, and in multiple languages, making it easy for families to file their taxes and keep money in their pockets. We went to Albany to secure the first increase in the city’s Earned Income Tax Credit in 20 years, and we are thrilled to offer New Yorkers NYC Free Tax Prep to help them receive their fair share this tax season.”

For in-person services, individuals should schedule an appointment in advance and bring identification and proof of income. For virtual services, individuals can upload their documents and meet virtually with a tax preparer to review their tax return before submission. A full checklist of the documents needed to file taxes is available online.

“Tax season can induce anxiety about filling in the right boxes, finding the proper forms, and trying to access all the credits for which you and your family may qualify,” said Deputy Mayor for Health and Human Services Anne Williams-Isom. “This year, take a moment to see if you qualify for support through this unique partnership with our public hospital system. In this case, your NYC Health + Hospitals provider might be able to also help you get the peace of mind you need with your taxes.”

“An annual tax refund is often the largest lump-sum payment families receive all year and something that many working New Yorkers count on — even more so since last year’s historic enhancement of the New York City Earned Income Tax Credit,” said Deputy Mayor for Housing, Economic Development, and Workforce Maria Torres-Springer. “Partnerships like the one between DCWP, NYC Health + Hospitals, and the city’s tax preparation partners help us meet New Yorkers where they are with free tax prep services that help them put a meaningful sum of money back into their pockets.”

“For over 20 years, NYC Free Tax Prep has helped file hundreds of thousands of tax returns,” said DCWP Commissioner Vilda Vera Mayuga. “This year, we’re helping filers keep more of their hard-earned money with the enhanced New York City Earned Income Tax Credit and our expanded NYC Free Tax Prep services for self-employed New Yorkers. Thank you to all of our amazing tax prep partners, like NYC Health + Hospitals and MetroPlusHealth, for working to help New Yorkers get their fullest refund.”

“We are proud to partner with NYC Tax Prep to support financial well-being by offering trusted services that save money on filing taxes and promote access to tax credits,” said Nichola Davis, MD, MS, vice president and chief population health officer, NYC Health + Hospitals. “We know that tax refunds can be the biggest influx of income over the course of a year for many, so we aim to alleviate financial stress in order to foster a healthier future for our patients.”

“We are proud to again offer New Yorkers help with filing their taxes this year,” said Steve Mitchell, vice president of sales, MetroPlusHealth. “Many families will benefit from this free service at select MetroPlusHealth community centers, as well as receive guidance on signing up for health insurance.”

NYC Free Tax Prep provides free, professional tax preparation that can help New Yorkers keep their full refund, including valuable tax credits, like the recently enhanced New York City Earned Income Tax Credit. NYC Free Tax Prep Services include:

In-Person Tax Preparation: At in-person tax prep sites, knowledgeable Internal Revenue Service (IRS) certified Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) volunteer preparers help filers complete an accurate tax return. More than 130 sites across the city will be open throughout the season.

Drop-Off Service: With drop-off service, filers can drop off their tax documents and pick up the completed return later.

Virtual Tax Preparation: Virtual Tax Preparation is an online service where an IRS-certified VITA or TCE volunteer preparer will video conference with filers to help prepare their tax return using a secure digital system. Filers can submit photos or scans of tax documents to the preparer, confirm their identity, and complete their return by video call with a preparer. Filers will need access to a computer, tablet, or smartphone; a stable internet connection; and the ability to download secure video conference software.

Assisted Self-Preparation: Assisted Self-Preparation allows filers to complete their tax return online on their own, and an IRS-certified VITA/TCE volunteer preparer will be available by phone or email to answer questions. Filers will need access to a computer, tablet, or smartphone; a stable internet connection; an email address; and their 2022 adjusted gross income or self-select PIN.

NYC Free Tax Prep Services are available now at over 130 VITA and TCE sites around the city. The IRS will accept returns through April 15, 2024. New Yorkers can call 311 or visit the NYC Free Tax Prep website and use DCWP’s interactive map to search for the most convenient free tax site near them.

Below are locations and hours for in-person free tax preparation at NYC Health + Hospitals and MetroPlusHealth sites this season:

In-Person Tax Preparation at NYC Health + Hospitals and MetroPlusHealth Sites

Bronx:

NYC Health + Hospitals/Gotham Health, Tremont

1920 Webster Avenue, Bronx, NY 10457

Saturdays, 9:00 AM – 3:00 PM

Available in English and Spanish

Schedule an appointment by calling (718) 993-8880 or going online

Brooklyn:

MetroPlusHealth – Brooklyn

2221 Church Avenue, Brooklyn, NY 11226

Fridays, 10:00 AM – 5:00 PM

Schedule an appointment by calling (347) 682-5606 or going online

NYC Health + Hospitals/Gotham Health, Broadway

815 Broadway, Brooklyn, NY 11206

Mondays, 2:00 PM – 7:00 PM

Schedule an appointment by calling (347) 682-5606 or going online

NYC Health + Hospitals/Gotham Health, East New York

2094 Pitkin Avenue, 1st Floor, P31, Brooklyn, NY 11207

Wednesdays, 9:00 AM – 5:00 PM

Schedule an appointment by calling (718) 784-0877

Manhattan:

NYC Health + Hospitals/Bellevue

461 1st Avenue, F-Link, Room CD49, New York, NY 10016

Fridays, 9:00 AM – 5:00 PM

Schedule an appointment by calling (718) 784-0877

Queens:

MetroPlusHealth – Flushing

136-13 Roosevelt Avenue, Flushing, NY 11354

Tuesdays and Thursdays, 9:00 AM – 5:00 PM; Saturdays, 10:00 AM – 5:00 PM

Available in English and Chinese

Schedule an appointment by calling (718) 784-0877

MetroPlusHealth – Jackson Heights

92-14 Roosevelt Avenue, Jackson Heights, NY 11372

Tuesdays, 9:00 AM – 5:00 PM; Saturdays, 10:00 AM – 5:00 PM

Available in English and Spanish

Schedule an appointment by calling (718) 784-0877

NYC Health + Hospitals/Elmhurst

79-01 Broadway, Main Lobby, Elmhurst, NY 11373

Tuesdays, Thursdays, and Saturdays, 9:00 AM – 5:00 PM

Available in English, Bengali, and Spanish

Schedule an appointment by calling (718) 784-0877

NYC Health + Hospitals/Queens

82-68 164th Street, Pavilion Building – Ground Floor, Room P053, Jamaica, NY 11432

Wednesdays, 9:00 AM – 5:00 PM

Available in English, Bengali, and Spanish

Schedule an appointment by calling (718) 784-0877

Virtual Tax Preparation Options

NYC Health + Hospitals/Gotham Health, Cumberland

Available in English and Spanish

Register Online

NYC Health + Hospitals/Gotham Health, Gouverneur

Available in English and Spanish

Register Online

NYC Health + Hospitals/Harlem

Available in English and Spanish

Register Online

NYC Health + Hospitals/Jacobi

Available in English and Spanish

Register Online

NYC Health + Hospitals/Kings County

Available in English and Spanish

Register Online

NYC Health + Hospitals/Lincoln

Available in English and Spanish

Register Online

NYC Health + Hospitals/Metropolitan

Available in English and Spanish

Register Online

NYC Health + Hospitals/North Central Bronx

Available in English and Spanish

Register Online

NYC Health + Hospitals/Gotham Health, Roosevelt

Available in English and Spanish

Register Online

NYC Health + Hospitals/South Brooklyn Health

Available in English and Spanish

Register Online

NYC Health + Hospitals/Woodhull

Available in English and Spanish

Register Online

“New Yorkers from every community and income bracket should have the resources they need to prepare and file their taxes on time,” said New York State Assemblymember Jenifer Rajkumar. “Mayor Adams’ partnership with NYC Health + Hospitals and community organizations will allow just that by providing tax preparation free of charge. As a representative from Queens, the most linguistically diverse urban area in the world, I am also proud that we are offering support in English, Spanish, Chinese, and Bengali — the four most commonly spoken languages in our borough. This important initiative will help all New Yorkers file accurately, maximize their refund, and avoid any errors.”