Of the Centre’s total budgetary expenditure, Karnataka’s share is now down to just 1.1 per cent

“What about the question of Karnataka’s fiscal health? Won’t the ‘five guarantees’ put an unviable burden on the exchequer? This question is based on the faulty assumption that the new Congress government must increase the budgetary expenditure to pay for the subsidies and income support it has promised. The new government has no reason to accept the interim budget passed by Karnataka’s outgoing BJP government. It can completely rejig all expenditure and make room for its own policies, which include paying for its poll promises. In other words, there is no reason to believe that the ‘five guarantees’ cannot be implemented without increasing the total expenditure of the state.”

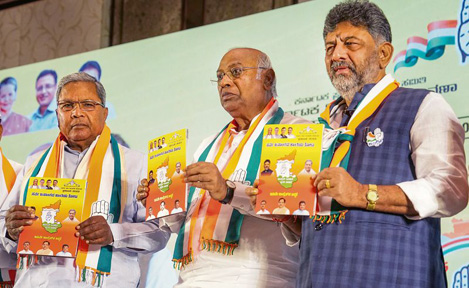

The Congress’ ‘five guarantees’ in Karnataka —Rs 2,000 a month to the female head of a family, monthly ‘dole’ for the educated unemployed, 10 kg of free rice for every member of BPL (below poverty line) families, 200 units of free electricity to each home and free travel for women on state buses — have made the commentariat very angry. It says these vote-buying ‘freebies’ will send the state deeper into debt. We are told that these poll promises will cost the state an additional Rs 50,000 crore, which will nearly double Karnataka’s fiscal deficit. And ultimately, the burden will fall on the honest taxpayer. The pundits also say that this kind of freebie politics may make economic sense in poor states, but not in a rich one like Karnataka. Let us begin with the second objection first. On the face of it, Karnataka is indeed a rich state. On an average, a person living in the state earns about Rs 22,000 per month. That makes Karnataka the fourth-richest state in India, just a shade behind Telangana and Haryana. But the average hides the reality. The richest five districts, clustered around Bengaluru and Udupi, which are home to about a quarter of Karnataka’s population, have a monthly per capita income of nearly Rs 45,000. The richest 10 districts, home to slightly more than one-third of the state’s population, have a per capita monthly income of Rs 36,000. The bottom 20 districts, where nearly two-thirds of Karnataka’s people live, have a per capita income of just Rs 13,800 per month. This is slightly lower than the national average. Again, the district averages hide deep income disparities within them. That suggests that an overwhelming majority of people in Karnataka do need income support and subsidies.

What about the question of Karnataka’s fiscal health? Won’t the ‘five guarantees’ put an unviable burden on the exchequer? This question is based on the faulty assumption that the new Congress government must increase the budgetary expenditure to pay for the subsidies and income support it has promised. The new government has no reason to accept the interim budget passed by Karnataka’s outgoing BJP government. It can completely rejig all expenditure and make room for its own policies, which include paying for its poll promises. In other words, there is no reason to believe that the ‘five guarantees’ cannot be implemented without increasing the total expenditure of the state. There is a deeper issue here — that of state revenues. Like all state governments, Karnataka, too, has limited avenues to raise its revenues. It has to depend on transfers from the Centre, because it is the Central government which collects the bulk of direct taxes and has access to other non-tax revenues. The Centre shares a certain amount of its gross tax revenue with states, and also gives grants-in-aid to them.

Between 2016-17 and 2019-20, Karnataka used to get 4.7 per cent of the share of taxes which went to states, and 5.4 per cent of the grants-in-aid. Of the total transfers made by the Centre to states, Karnataka’s share stood at 4.9 per cent. If one compares it with the Centre’s total Budget in this period, then Karnataka’s share was 2.3 per cent.

This fell drastically after the 15th Finance Commission’s recommendations were implemented in 2020-21. In the latest Budget, Karnataka has been allocated only 3.6 per cent of the gross tax revenue going to states. Its share in total grants-in-aid is down to just 2.2 per cent. Its share in the total transfers to states has dropped to just 3.1 per cent. Of the Centre’s total budgetary expenditure, Karnataka’s share is now down to just 1.1 per cent — less than half of what it was before 2020-21. If Karnataka had received Central transfers at the same rate as it did before the 15th Finance Commission, the state would have got an additional Rs 53,000 crore. This would have been enough to pay for the Congress government’s ‘five guarantees’.

However, there is a justifiable reason for reducing Karnataka’s share in the transfers to states. It is one of the richest states in India, despite the high inequality, and, therefore, it needs less support than poorer states do. However, even if one were to accept the 15th Finance Commission’s logic, Karnataka deserves more funds from the Centre. Not just Karnataka, but every single state is getting less than what it deserves.

This is because the states are not getting their legitimate share of the total taxes being collected by the Centre. The 15th Finance Commission recommended that the Centre must share 41 per cent of the gross tax revenue with state governments. But the Centre has never really given that much. Between 2016-17 and 2019-20, the Centre transferred 35 per cent of its gross tax revenue. In the past two years, it has given just 31 per cent.

The Centre has managed this by taking advantage of a loophole — that it does not need to share the taxes it collects through cesses and surcharges. Between 2016-17 and 2019-20, cesses and surcharges accounted for 16.5 per cent of the gross tax revenue collected by the Centre. This has gone up to more than 25 per cent in this fiscal. Because of cesses and surcharges, states got an average of 20 per cent less than what they deserved between 2016-17 and 2019-20. Now they are getting a whopping 33 per cent less than their legitimate share of the gross tax revenue collected by the Centre. If the pre-2020-21 average had been retained, states would have got Rs 72,000 crore more than they are getting this fiscal.Not just tax revenues, the Centre has also reduced the total grants-in-aid that it was giving to states. Between 2016-17 and 2019-20, about 17 per cent of the Centre’s Budget was going to states as grants-in-aid. This has now dropped to just 13 per cent. If one looks at the total transfers to states as a proportion of the Centre’s total Budget, between 2016-17 and 2019-20, the states were getting 46 per cent; now they are getting 36 per cent. In terms of the latest Budget, there is a drop of

Rs 4.6 lakh crore. If states had got their legitimate dues, Karnataka, too, would have got a part of them. That would have gone a long way in paying for its five guarantees.

(The author is a senior economic analyst)

Be the first to comment