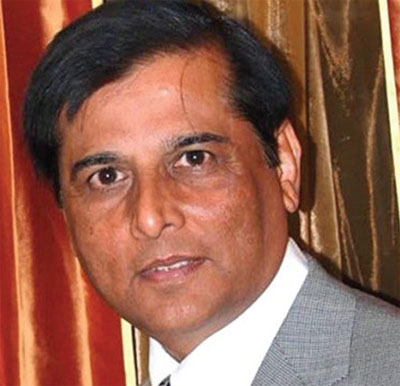

MILWAUKI (TIP): On February 1, 2013, the U.S. District Court for the Eastern District of Wisconsin sentenced Arvind Ahuja, a Milwaukee neurosurgeon, to serve three years of probation and to pay a fine of $350,000 following his conviction by a federal jury of one felony count of willful failure to file a Report of Foreign Bank Account (“FBAR”) and one felony count of filing a false federal income tax return.

According to the evidence presented at Ahuja’s August 2012 trial, Ahuja transferred millions of dollars from bank accounts in the United States to undeclared bank accounts located in India at HSBC bank. Ahuja invested the funds in these accounts in certificates of deposit, which earned more than $2.7 million in interest income during the years 2005 through 2009.

Ahuja also maintained an HSBC bank account in the Bailiwick of Jersey, a British Crown dependency located in the Channel Islands off the coast of Normandy, France. Ahuja used credit and debit cards linked to this account to pay personal expenses while on trips to London. Ahuja managed his offshore accounts with the assistance of bankers who worked at an HSBC India representative office in New York.

Ahuja’s sentencing is only the latest in a string of taxenforcement news that affects Americans with undeclared offshore bank accounts generally and Indian Americans with unreported non-resident Indian or “NRI” bank accounts specifically. Banks with operations in India offer high interest rates on NRI accounts, usually 9-10%. Unsuspecting account holders may not realize that although the interest income from NRI accounts is typically not taxable in India, it is taxable in the U.S.

In addition to reporting the interest income and the existence of the account on a U.S. tax return, the account holder must separately disclose the foreign account by filing a FBAR. In December 2010, Vaibhav Dahake of New Jersey pleaded guilty to conspiring to defraud the United States. Sanjay Sethi, also of New Jersey, pleaded guilty on January 7, 2013 to the same charge. Californian Ashvin Desai faces trial on July 23, 2013 for tax evasion, aiding in the preparation of false tax returns, and willful failure to file FBARs.

All of these Indian Americans are alleged to have maintained undeclared accounts at HSBC India. According to a court filing by the U.S. Department of Justice, there are 9,000 U.S. residents of Indian origin who have $100,000-minimum-balance accounts at HSBC India alone. Undoubtedly, there are many more whose account balances total less than $100,000. According to the DOJ, however, for calendar year 2009, the most recent year for which information is available, there were only 1,391 FBARs filed disclosing 1,921 accounts at HSBC India.

On April 7, 2011, the U.S. District Court for the Northern District of California granted the IRS and DOJ’s request for a “John Doe summons” to force HSBC India to turn over the names of U.S. taxpayers “who at any time during the years ended December 31, 2002 through December 31, 2010, directly or indirectly had interests in or signature or other authority (including authority to withdraw funds; trade or give instructions or receive account statements, confirmations, or other information, advice or solicitations) with respect to any financial accounts maintained at, monitored by, or managed through The Hongkong and Shanghai Banking Corporation Limited in India (HSBC India).”