MINEOLA, NY (TIP): The federal Securities and Exchange Commission has requested documents from the Town of Oyster Bay regarding disputed $20 million loan guarantees obtained by indicted contractor Harendra Singh, says a December 11 Newsday report.

The town has also received inquiries from acting Nassau County District Attorney Madeline Singas about the loan guarantees.

Oyster Bay disclosed the inquiries in a borrowing prospectus for $3.3 million in bond anticipation notes that were sold last week.

Oyster Bay’s outside counsel Jonathan Pickhardt of Manhattan said Thursday that the inquiries were about Singh’s companies “and their agreements with the town related to the various concessions, and the SEC in addition has asked for information around some disclosures by the town.”

Oyster Bay officials said in the borrowing document that they have and will continue to comply with the requests.

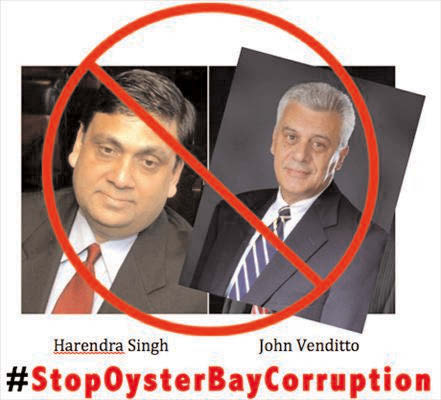

Federal authorities indicted Singh in September on 13 charges that included bribing an Oyster Bay official to obtain loan guarantees. He pleaded not guilty.

Pickhardt said in an email that the town was also providing documents to federal investigators relating to Singh’s indictment.

The loans were supposed to finance capital construction at town facilities where two Singh companies, S.R.B. Convention & Catering Corp. and SRB Concessions Inc., have concessions agreements that extend for at least 50 years.

Newsday has reported that the town’s failure to disclose those potential liabilities in past bond documents could bring sanctions and criminal charges by the SEC. The town said in its new disclosure document that the loan guarantees are invalid, unenforceable and were “entered into without the involvement or knowledge of necessary town officials.”

Singas said in a statement that “Taxpayers should not guarantee loans to a private business.” She could not comment on pending investigations but said that “any allegation that public resources have been illegally used for private gain will be fully investigated by my office.”

Singas’ office requested the information on Aug. 25, according to the Oyster Bay disclosure document, two days after Newsday published an article about the town guaranteeing loans on behalf of Singh.

SEC spokeswoman Judith Burns declined to comment on the requests made on Oct. 20.

Singh’s attorney, Anthony LaPinta of Hauppauge, said in a statement that “no crimes were committed in obtaining the loans, I am more than willing to discuss this investigation with the Securities and Exchange Commission and the Nassau County DA’s office, as I have with the U.S. Attorney’s Office.”

The disputed $20 million loan guarantees bear notarized signatures of Town Attorney Leonard Genova. Pickhardt said he could not comment on Genova’s signatures.

In 2010, the town board authorized the town attorney to sign contracts if the town supervisor was “absent or unavailable.” The $20 million loan guarantees were signed in 2011 and 2012.

Town officials have portrayed the loan guarantees as the actions of a lone wolf in the town attorney’s office.

Singh and Town Supervisor John Venditto and other officials have been intertwined through political contributions and the family charity, the Raj & Rajeshwari Foundation. No town officials have been charged in the federal investigation.

Be the first to comment