BEIJING (TIP): Global defence contractors are circling for business in Asia, with countries from Australia to Vietnam upgrading and adding everything from submarines to fighter jets as China expands its military reach.

According to consultancy IHS Jane’s report, the combined defence budgets in the Asia-Pacific region will grow from $435 billion last year to $533 billion in 2020, furthering a shift in global military spending away from Western Europe and North America toward emerging markets, especially in Asia. The figure will put Asia-Pacific on par with North America, which is expected to account for a third of global defence spending by then, from almost half now.

The report attributes the rise to growing tensions in the South China Sea. “A number of the South China Sea’s littoral states appear to be responding to China’s more assertive stance in the region and there is no sign of this trend coming to an end,” Janes’ principal analyst, Craig Caffrey, said in the report. China had the region’s biggest defence budget at $146 billion last year, according to the government. Jane’s said it expects China’s budget to rise by about 5% to $233 billion by 2020.

While military spending in Asia is coming off a low base – especially in Southeast Asia -and remains a small proportion of gross domestic product, nations that for years relied on old and at-times outdated ships and planes are starting to renovate their fleets. “There is a wide-ranging need for modernization across most of the armed forces in the region,” said Dan Enstedt, chief executive officer of Saab Asia Pacific, whose products include submarines, missiles, radars and fighter jets. “There are many examples of old and obsolete equipment fleets that are unable to keep pace with changing national security needs.”

Military outlays in Asia and Oceania -which includes Australia and New Zealand -grew 5.4% in 2015, outpacing a 1% rise in global spending, according to the Stockholm International Peace Research Institute. Indonesia boosted spending last year by 16%, the Philippines by 25% and Vietnam by 7.6%.

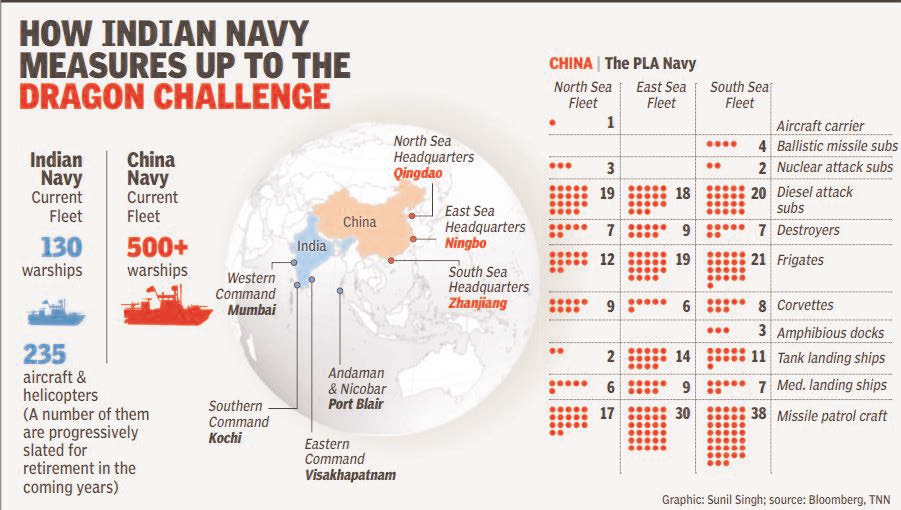

Much of the spending is on air and naval capacity amid China’s assertiveness in the East China Sea, where it claims islets contested by Japan, and the South China Sea, where its land reclamation programme has spooked other claimants. “The growth of China’s national power, including its military modernization, means China’s policies and actions will have a major impact on the stability of the Indo-Pacific,” according to Australia’s Defence White Paper published in February.

A quarter of Australia’s defence investment over the next decade will be devoted to maritime capabilities.

Still, much of the spending comes off a low base. The Philippines spent 1.3% of GDP last year, up from 1.1% in 2014, according to Sipri, while Vietnam was largely flat at 2.3% of GDP.

China’s outlays were 1.9% of its economy, well below US expenditure last year of 3.3% of its economy.

Thailand may be one growth center this year. Defence spending will increase 7.3% and account for 7.6% of the overall budget, the Bangkok Post reported last month. On Thailand’s shopping list: 12 MI-17 transport helicopters from Russia, and four South Korean-made T-50 TH training aircraft.

Australia in April awarded an A$50 billion ($36 billion) contract for 12 submarines to France‘s DCNS Group, in one of the world’s biggest defence deals. The government is considering tenders for nine warships worth A$35 billion and a A$3 billion deal for 12 offshore patrol vessels.

Indonesia, Japan, China, Vietnam, Singapore, Pakistan and Vietnam are building or buying submarines. Pakistan last year agreed to buy eight diesel electric submarines from China for an undisclosed price.

The greater reach of China’s air force is helping driving sales of planes. China has deployed combat aircraft on Woody Island in the disputed Paracel chain.

India needs dozens of warplanes after it scaled back a big order for Dassault Aviation SA’s Rafale jets to 36. Though no quantity has been announced, Boeing, Lockheed Martin and Saab have made pitches to build combat planes in India. About a third of India’s 650 fighter jets are more than 40 years old.