Greece became the first developed country to default on the International Monetary Fund, as the rescue program that has sustained it for five years expired and Greece’s last-minute overtures to international creditors for financial aid on Tuesday, June 30, were not enough to save the country.

The Washington-based fund said the Greek government failed to transfer €1.55 billion ($1.73 billion) by close-of-business on Tuesday—the largest, single missed repayment in the IMF’s history.

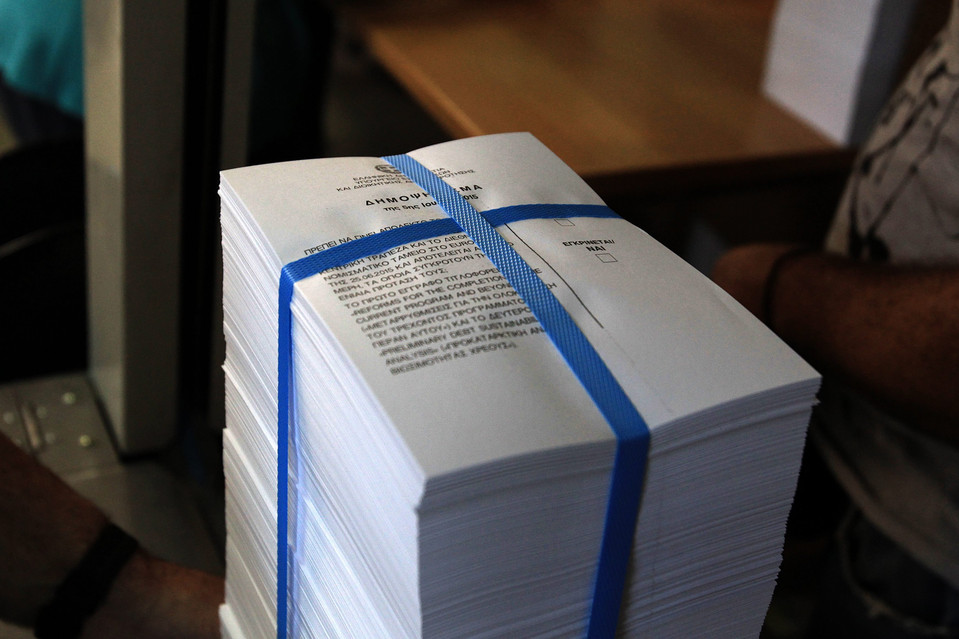

Fears of a Greek default have unnerved financial markets on concerns that it would ultimately lead to the country’s exit from the euro common currency. The fate of Greece’s membership in the 19-nation currency bloc still hangs in the balance ahead of a referendum on Sunday when Greek citizens will vote on whether to accept the austerity terms of continued international aid.

An opinion poll published on Wednesday in the Efimerida ton Syntatkton newspaper, said 54 percent of Greeks plan to oppose the bailout proposal against 33 percent in favor. Late yesterday, June 20, Greek officials were also raising doubts over their plans for a referendum planned for Sunday, in which the government had asked its citizens to vote against pension cuts and sales-tax increases demanded by its creditors.

However a breakdown of the results compared with a poll taken before the decision on Sunday to close Greek banks showed the gap between the “yes” and “no” votes narrowing slightly.

IMF spokesman Gerry Rice said Greece can now only receive further funding from the global lender once the arrears are cleared. He confirmed that Greece asked for a last-minute repayment extension earlier on Tuesday, June 30, which the fund’s board will consider “in due course.”

in Berlin, Chancellor Angela Merkel and other senior officials sought to lower expectations for a quick resolution to Greece’s financial crisis.

Before Greeks have voted on the measures demanded by creditors, “we will not negotiate about anything new at all,” Ms. Merkel said. Her deputy and coalition partner, Sigmar Gabriel of the Social Democrats, urged Greece to cancel the referendum altogether. “Then one could very quickly gather for talks, initial talks. If that’s not the case, then we should certainly do this after the referendum,” Mr. Gabriel said.

European stocks and bonds fell amid the uncertainty and the euro declined against the U.S. dollar.

In Washington, President Barack Obama played down the potential impact of Greece’s worsening crisis on the U.S. and broader global economy. “That is not something that we believe will have a major shock to the system,” he said.

Treasury Secretary Jacob Lew has been urging his European counterparts to press ahead with bailout talks to find a “pragmatic compromise” that includes both tough economic overhauls and debt relief, to prevent Europe’s economic problems from dragging on U.S. growth.

The expiration of the existing bailout and a default on the IMF aren’t expected to have immediate consequences for Greece’s economy. Its banks have already been ordered closed until Monday, after the European Central Bank capped emergency loans to Greek lenders over the weekend. Cash withdrawals by Greeks have been limited to €60 a day for each account-holder since Monday.

On Wednesday, Jul 1, the focus will again be on the ECB, whose governing council is due to meet in Frankfurt.

The council, which includes central bankers from the eurozone’s 19 member states, is reluctant to take any additional steps for now that would inflict more pain on Greek banks—for instance, by forcing them to pay back the outstanding loans just days ahead of the referendum, people familiar with the matter said, despite a growing level of impatience over the central bank’s exposure to Greece.

Be the first to comment