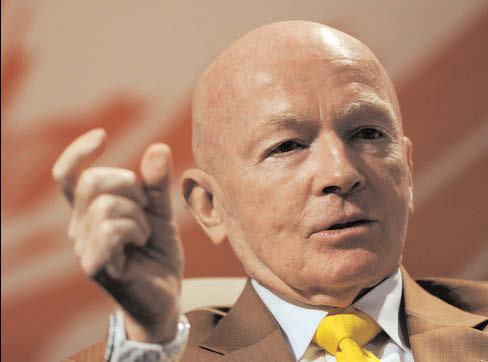

MUMBAI (TIP): Emerging markets guru Mark Mobius said India could overtake China in the Templeton Emerging Markets group’s equity investments over the next five years, given the strong growth prospects of Asia’s third-largest economy and provided much-awaited reforms see the light of the day.

Mobius, who is executive chairman of the Templeton Emerging Markets Group at Franklin Templeton Investments, said China accounts for 8% of the group’s equity investment, followed by India with a 3% share. But, he added, the gap could close in time to come.

“If you look at where we are invested China is at the top of the list, followed by India and Thailand, will be the next two,” Mobius said in an interview on the sidelines of an event. “Going forward India is going to become more important, simply because it’s got better growth prospects,” said Mobius, adding that it was important that reforms went through as well.

India’s economic growth accelerated to 7.4% in the second quarter of the current financial year, riding on a spike in manufacturing and a pickup in investment demand, government data showed on Monday.

The ongoing reforms process was also key to Mobius’ rationale for investments in India. “The demographics are in favour. It’s a young population, and a growing population. Secondly, the reforms process is moving ahead. Modi has set an agenda for reforms,” he said. Although some people were concerned about the speed, he said, it was not as important as the direction of reforms.

“These things (reforms) take time, but the direction is very clear,” added Mobius. The reforms process initiated by the government led by Prime Minister Narendra Modi was off to a slow start—compared with expectations—with a political logjam in previous Parliament sessions stalling the passage of crucial legislation. Hopes have risen now that things may move ahead better than expected from here on.

Mobius does not expect the opposition Congress party to put barriers in the path of the ruling Bharatiya Janata Party (BJP) to get the reforms through. Last week, leaders of the BJP and Congress met at Modi’s residence, spurring hopes that the constitutional amendment bill to enable the goods and services tax (GST) will finally get Parliament’s nod. Modi invited Congress president Sonia Gandhi and former Prime Minister Manmohan Singh to discuss issues related to the winter session of Parliament, including the GST bill.

Mobius said Modi’s performance as Prime Minister has been more or less in line with what he had expected, but added that he is capable of doing more.

“I didn’t expect much more, (than what has happened), but I would say that in terms of what he could do, maybe we are talking about 75-80%,” said Mobius.

According to him, investors could wait for another year for the government to deliver on reforms, and GST was the key reform. “If that’s delivered, that would be a watershed. That would be something.”

The key risk to Indian markets was also deliveries on the reforms front, at this point.

“Its really these reforms at the end of the day,” he said adding that rural electrification and reforms of the tax system were the big issues facing the Indian markets.

There has been a debate on whether there is rising intolerance in the country, and the rising intolerance has dampened the sentiment for Modi, added Mobius.

“It already is a hurdle. It is a problem for him, and it very difficult for him,” said Mobius. “I think his policy of not talking about it is probably a good one, because when it comes to religion, faith, class, these are emotional subjects.”

“All these conflicts have their base in economics. When people don’t have jobs, if their standard of living is not good, and see what other people have and they don’t have it, they get angry,” he said.

“So, I think it is definitely a problem for him but he is probably wisely trying to keep away from that and focus on his job at hand.”

Mobius likes the consumer and infrastructure sectors in the Indian market, while he would avoid natural resources at this time. He expressed concern over state-owned banks, and emphasized that privatization was key.

“They’ve got to get these state-owned banks out from under government control and put them on a stable basis with market-oriented policies, and that would be a giant step forward for not only for the banks, but also the government,” Mobius said.

He said the recent outflows from emerging markets could reverse after the US Federal Reserve’s policy decision.

“It is true that emerging markets have underperformed for the last three years and therefore a lot of investors have pulled money out of the emerging market funds,” said Mobius.

“I believe that once the uncertainty caused by the Federal Reserve’s interest rate policy is out, then money will begin to flow again back in to emerging market.”

Be the first to comment